With the continuous strong demand for AI servers and the significant expansion of CoWoS capacity, shipments of high-end server AI accelerators are expected to grow by more than 200% in 2024, reaching 7.67 million units.

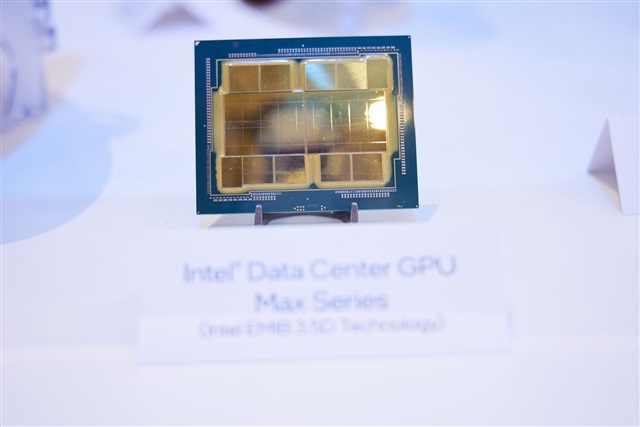

Nvidia will lead in shipments, with an estimated market share of 46.7%, followed by Google with a 33.1% share. Notably, producing high-end server AI accelerators heavily relies on TSMC's 4/5nm advanced process technology and CoWoS-S advanced packaging technology, making other IC makers like Intel and Samsung have limited manufacturing and packaging business opportunities in high-end server AI accelerators, according to a DIGITIMES Research estimate.

From the demand side, global large server datacenter operators will continue to deploy related services in 2024, increasing the procurement of high-end AI servers. On the supply side, the production capacities of 2.5D and 3D packaging processes and high bandwidth memory (HBM) will continue to expand in 2024.

Table 1: Server AI accelerator specifications by market sector

Table 2: Key factors affecting server AI accelerator shipments in 2024: Demand/Supply

Chart 1: High-end AI server and server accelerator shipments, 2023-2024 (k units)

Chart 2: Global 2.5D packaging capacity demand by major firm, 2023-2024 (k 12-inch wafer units)

Table 3: High-end server AI accelerator models by major companies, 2024

Chart 3: High-end server AI accelerator shipment share by architecture type, 2023-2024

Chart 4: High-end server AI accelerator shipment share by supplier, 2024

Chart 5: High-end server AI accelerator shipment share by manufacturing node, 2024

Chart 6: High-end server AI accelerator shipment share by adopted packaging technology, 2024

Table 4: Status of high-end server AI accelerator industry, 2024